Ambit Finvest Pvt. Ltd. (Ambit Finvest), the Non-Banking Financial Company (NBFC) of the Ambit Group, announced a co-lending arrangement with the Central Bank of India to offer MSMEs loans.

RBI’s Co-lending framework embodies a collaborative approach that harnesses the complementary strengths of banks and NBFCs to bolster lending in the priority sector.

Sanjay Agarwal, CEO, Ambit Finvest expressed his enthusiasm by stating, “We are delighted to join hands with the Central Bank of India to expand its outreach and cater to the credit needs of MSMEs. This strategic alliance empowers Ambit Finvest to extend it’s services to a broader geographical spectrum, offering competitive interest rates on business loans to numerous MSMEs that previously faced challenges accessing banking services due to higher interest rates. Moreover, collaborating with a pioneering institution like the Central Bank of India enables Ambit Finvest to further expandits footprints in the MSME segment.”

Co-lending presents a mutually beneficial strategy wherein smaller NBFCs, often operating in remote areas and contributing significantly to growth and socio-economic development, receive support to expand their business reach and income by leveraging the bank’s robust balance sheet. Meanwhile, banks, through risk and reward sharing can broaden their geographical reach and fulfil their Priority Sector Lending obligations.

The ultimate beneficiaries of such partnerships are MSMEs, who can gain access to credit more swiftly and at more affordable rates.

More Stories

Mastercard collaborates with City Union Bank to unveil its first passion cards for cricket lovers in India

Classmate Unveils eduGAMES Infinity Campaign: Bringing Back the Joy of Learning, One Game at a Time

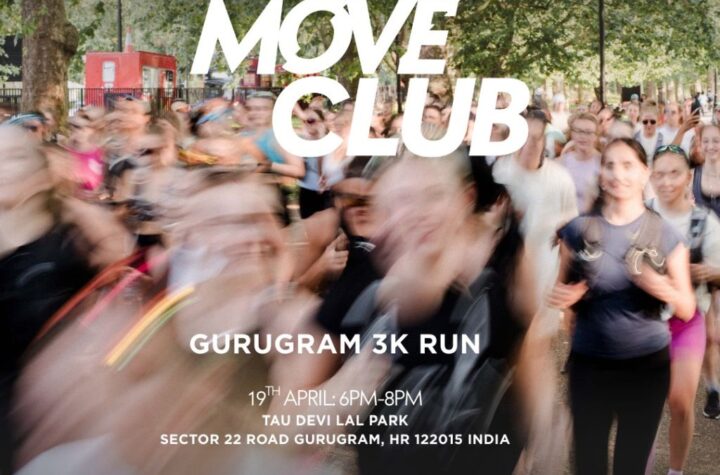

Myprotein’s Move Club Continues to Grow,Brings 3KM Run to Gurugramand third edition in Delhi